- Group strengthens financial position post-merger and continues successful expansion strategy

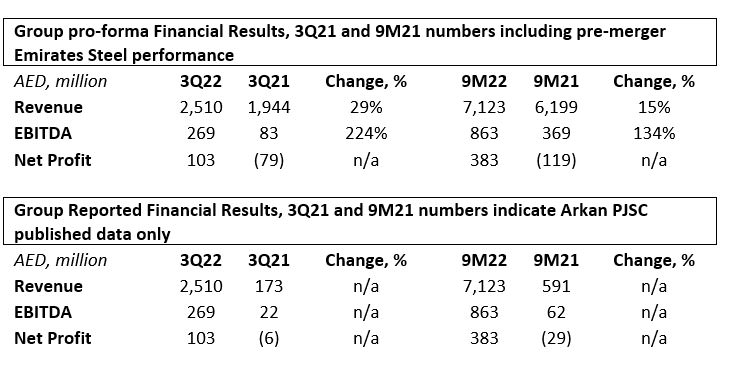

- 3Q22 revenues rose 29% year-on-year to AED 2.51bn compared to 3Q21 pro-forma AED 1.94bn

- 3Q22 EBITDA advanced to AED 269m versus pro-forma AED 83m during 3Q21

- 3Q22 net profit increased to AED 103m against pro-forma loss of AED 79m in 3Q21

Abu Dhabi, United Arab Emirates, 1 November 2022: Emirates Steel Arkan (ADX: EMSTEEL) (the “Group”), the largest publicly traded steel and building materials company in the UAE, today announced its third quarter results.

In 3Q22 revenues rose 29% to AED 2.51 billion, compared to pro-forma AED 1.94 billion in the corresponding quarter last year. The Group’s 3Q22 EBITDA gained 224% year-on-year (“YoY”) to AED 269 million.

The Group reported a net profit of AED 103 million in the third quarter compared to a pre-merger pro-forma loss of AED 79 million in the same period of last year. The gains were driven by the Group’s strategy to diversify revenues through increased exports to over 70 markets, prudent cost control and an increase in operational efficiencies.

Revenues for the first nine months of 2022 rose to AED 7.12 billion versus pro-forma AED 6.20 billion in the same period last year. The Group reported EBITDA of AED 863 million, a 134% YoY increase from pro-forma AED 369 million in 9M21. Net profit in the first nine months of 2022 was AED 383 million compared to a pre-merger pro-forma loss of AED 119 million in 9M21.

Following the merger, in the final quarter of 2021, the Group’s steel business continued to contribute 90% of revenues while building materials comprised 10%. Revenue from the steel business during 9M22 rose to AED 6.45 billion compared to an unconsolidated pre-acquisition revenue of AED 5.6 billion for 9M21, bolstered both by strong sales into Europe and the Americas and increased volume of orders in the UAE.

On a stand-alone basis, the building materials business continued to perform robustly amid pro-active marketing campaigns, higher prices and enhancements to the Group’s low-cost production base. The division produced a 9M net profit of AED 48.9 million compared to a 9M21 loss of AED 29.2 million, a turnaround of AED 78.1 million.

The Group’s balance sheet also significantly improved at the end of the nine-month period, reflecting the success of the Group’s “Namaa’’ cost reduction and transformation program as well as the enhanced volume of sales and price increases during the period. Net borrowings decreased 41% to AED 1.34 billion as at 30 September 2022 compared to AED 2.28 billion as at 31 December 2021.

Hamad A. AlHammadi, Chairman, Emirates Steel Arkan, said: “The Group’s robust third-quarter earnings demonstrate the success of its strategy of focusing on new opportunities in its 70 international export markets. The Group also remains committed to its home market and supporting Abu Dhabi’s Industrial Strategy. To that end, it is accelerating efforts to aid the growth of local industries and to enhance the ‘Make it in the Emirates’ brand and is studying options for producing flat steel for manufacturing industry customers. The UAE economy is forecast to maintain its strong growth despite the expected global downturn, providing a dynamic backdrop for the Group to continue implementing its expansion plans. During the quarter, the Group announced that it had partnered with ITOCHU Corporation and JFE Steel Corporation to study the construction of a ferrous raw material production facility in Abu Dhabi.”

If approved, the plant would become an integral part of the global low carbon emission steel supply chain, further aligning the Group’s strategy with the UAE’s decarbonization targets. The ferrous raw materials produced will be supplied to customers primarily operating in Asia, including JFE Steel.

Eng. Saeed Ghumran Alremeithi, Group Chief Executive Officer, Emirates Steel Arkan, said: “As we celebrate the first anniversary of the merger the Group continues to take initiatives to enhance output and reduce costs, while ensuring rigorous health and safety protocols across our operations. These measures have enabled us to continue strengthening the financial position of the Group, as reflected in our higher year-on-year profitability and significantly lower level of debt. Our solid financial position provides us with increased confidence to execute our growth strategy as we introduce new products and implement our expansion plans. Even though the outlook for raw material markets and the global economy remains uncertain, the growth prospects for the UAE are encouraging and our increasingly diversified business model will allow us to take advantage of opportunities as they arise.”

Despite the increasing global economic headwinds amid high inflation, a slowdown in Chinese economic growth and heightened geopolitical tensions, the Group highlighted that the UAE remained a bright spot. The Group noted that International Monetary Fund is predicting that the UAE’s GDP will grow 4.2% in 2023, outpacing its 2.7% global growth forecast, a macroeconomic backdrop that would be supportive of the Group’s performance next year.

Related posts

#DidYouKnow that the Glass-fiber Reinforced Polyester (GRP) Jacking Pipes are the preferable choice when compared to traditional concrete pipes? Currently, many old concrete installations are being replaced by flexible pipes such as GRP as they are one of the many construction products that #EmiratesSteelArkan manufactures in its facilities.

Read more

#EmiratesSteelArkan is committed to quality above all. This is why our products are in constant demand for all kinds of projects worldwide. To be part of the construction of focal landmarks in the region and the world, such as the new Kuwait International Airport Terminal, is an honor, and we plan to continue living up to our reputation of being the top-quality suppliers of steel products in the region.

Read more

#Steel, which cannot be utilized in its pure form, must be cast into shape before it is used. The newly created steel, which is a solid bar of metal, is called steel billet. #EmiratesSteelArkan uses the continuous casting method to allow billets of varying lengths to be produced swiftly, efficiently, and more importantly, to the same quality of certified consistency and standard.

Read more